State revolving fund loan information

Low-interest loans

We offer loans with very low-interest rates so that they are affordable to pay back. These loans come from the State Revolving Fund program.

The State Revolving Fund finances the design and construction of Colorado water, wastewater, and stormwater infrastructure. We administer the fund along with the Department of Local Affairs, and the Colorado Water Resources & Power Development Authority. We manage environmental reviews, engineering design approvals, and conduct overall project management. The power authority manages the finances and loan approvals. Local affairs staff members work with applicants on credit reviews and reports.

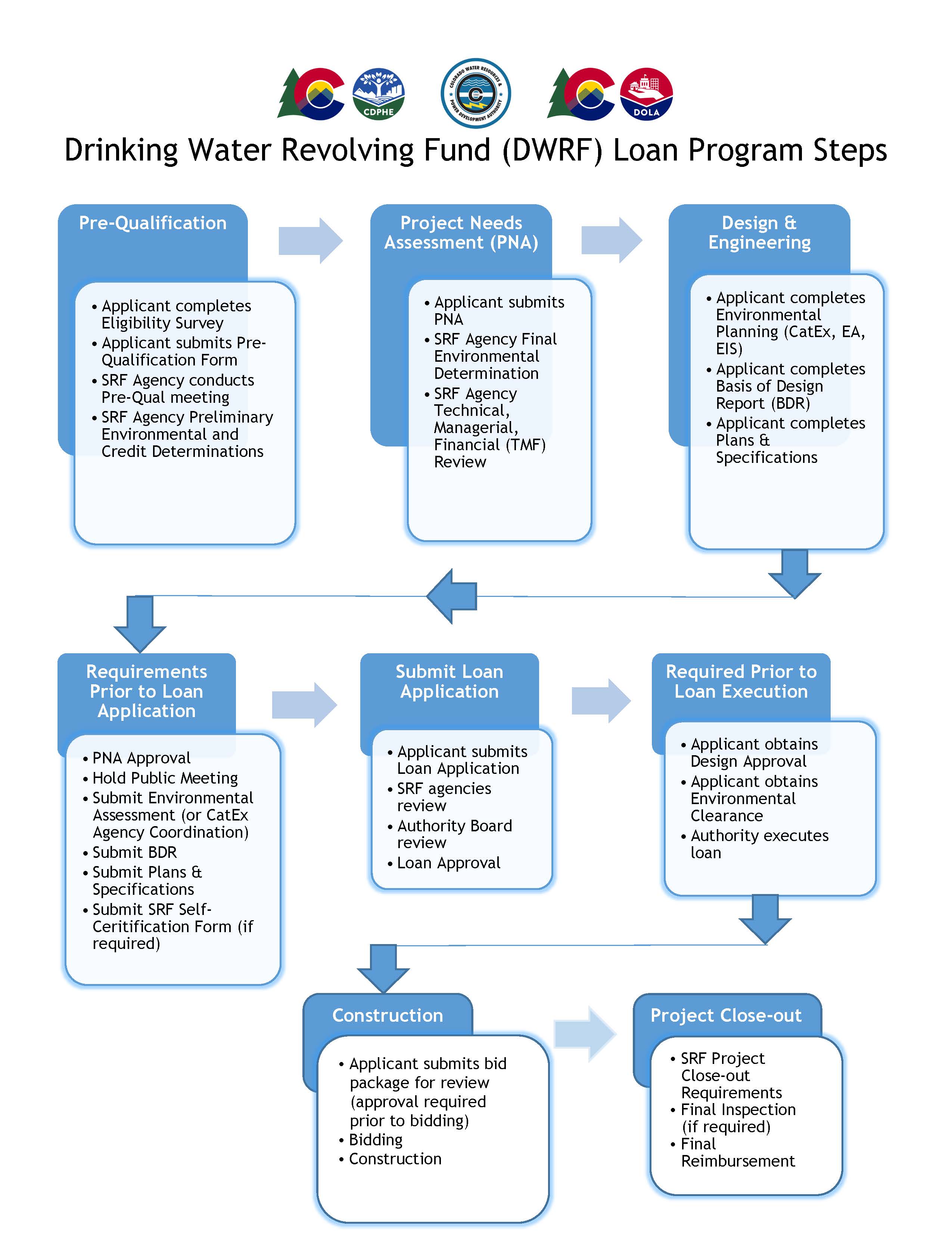

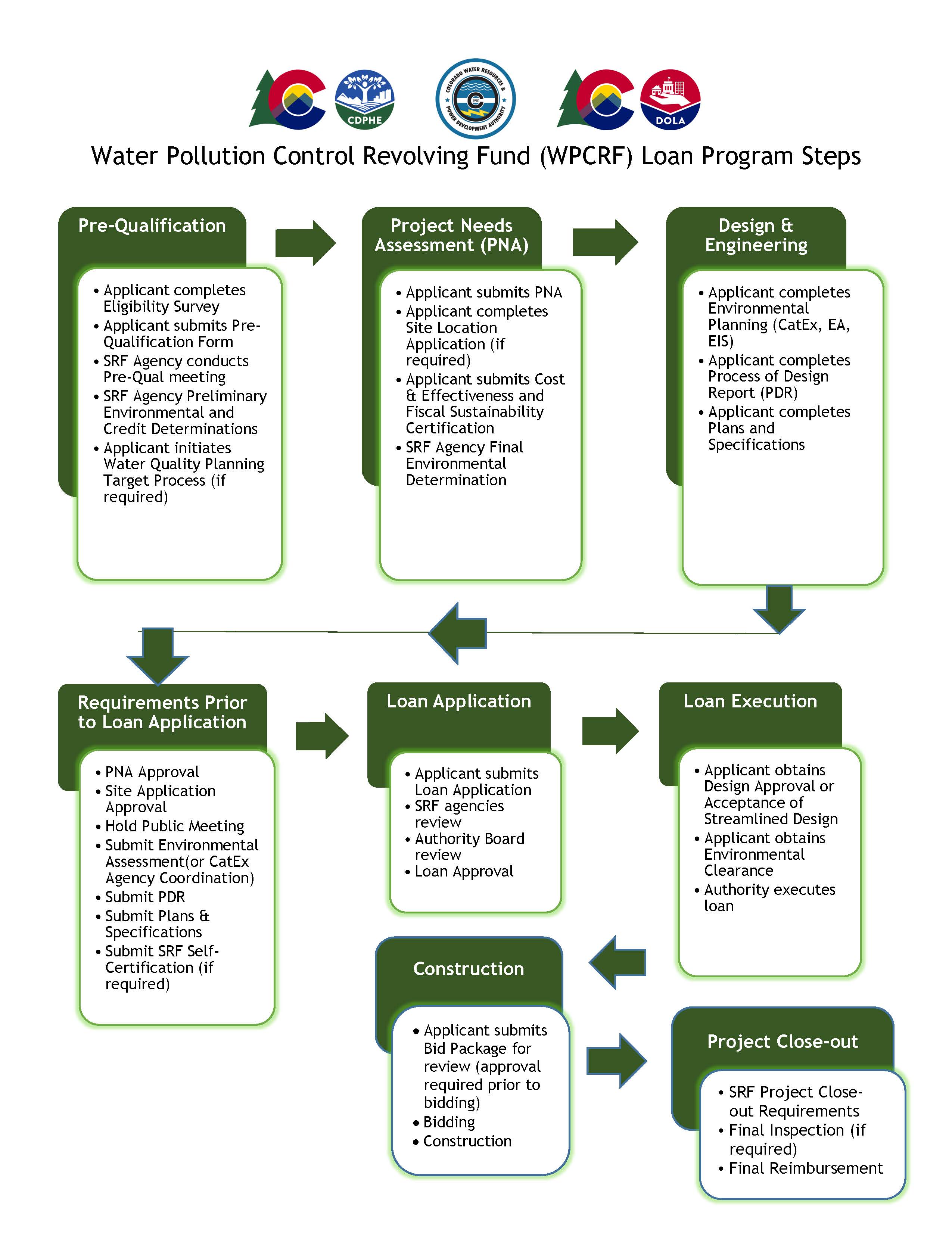

Steps for low-interest loans

Apply for eligibility

State Revolving Fund annual eligibility survey

Eligibility criteria and survey instructions

- The 2025 eligibility survey is closed.

- The 2026 eligibility survey will open on May 1, 2025

- Submission deadline is June 30, 2025

The eligibility survey is used to identify the 20-year capital improvement needs of all publicly owned water and sewer systems, private nonprofit water systems, publicly owned stormwater systems, and non-point source projects throughout Colorado.

We issue the annual eligibility survey process through an online platform, the Colorado Environmental Online Services (CEOS). Eligible entities on this system receive a notification to fill out the survey. You cannot receive this funding unless you participate in the eligibility survey.

- This survey is the first step in the State Revolving Fund application process.

- The survey is not an application, and completing it does not require that you apply for financial assistance.

- When the survey is complete, your system’s infrastructure needs will be identified and included in Appendix A Project Eligibility List of the below Intended Use Plans. The plans are updated annually and are effective from January through December. Entities seeking funding for their water and sewer projects must be included on the applicable list prior to applying for funding.

Submitting forms

All forms are processed using Colorado Environmental Online Services (CEOS). New users will first need to create their CEOS user account before accessing the survey. If you are new to CEOS, please review the below instructions for helpful tips on account setup.

After submitting your forms, check for confirmation that the form was received using the spreadsheet link below.

The intended use plan (often referred to as the IUP) outlines a framework for using the funds, financing water quality infrastructure projects, and supporting related program activities during the calendar year. The IUP summarizes the results of the eligibility survey.

2026 Intended use plans (IUP)

2025 Intended use plans (IUP)

Apply for loan

The pre-qualification form is the first step in actively applying for a State Revolving Fund (SRF) Loan.

After submitting the short pre-qualification form, project managers will schedule a pre-qualification meeting with applicants to discuss the next steps in the SRF loan process. If eligible, grants for planning, design, and engineering will also be discussed at this meeting.

- Architectural and engineering procurement fact sheet.

- Architectural and engineering procurement certification form.

Has your system completed the annual eligibility survey?

If not, please complete the survey in June each year. We recommend all systems complete the eligibility survey to prepare for any potential federal stimulus funding made available through the SRF programs. Only systems included on the eligibility lists will be eligible to receive stimulus funding through the SRF, therefore, it is particularly important to complete the surveys this year through CEOS.

Submit all applications and forms using Colorado Environmental Online Services (CEOS)

After the three agencies that administer the state revolving fund program review the application, the owner completes and submits the project needs assessment and environmental checklist electronically to their assigned division project manager. Supporting documentation is required and should be attached to the PNA along with the environmental checklist submission.

Technical, managerial, and financial assessment (drinking water projects only)

Public meeting

The public meeting must be properly noticed at least 30 days before in the legal section of the local publication.

Submit all applications and forms using: Colorado Environmental Online Services (CEOS)

Bid specifications

Owners must submit all bidding and contract documents prior to bid advertisement. Bidding and contract documents must include the SRF required specifications. A copy of the SRF Required Specifications must be requested from the GLU Project Manager. The Project managers must review and verify that required current bid specifications are included prior to any bidding and contract execution.

- Navigating SRF requirements for borrowers.

- SRF design review fact sheet.

- The Engineering Section will review each facility in accordance with the design criteria.

Cost and effectiveness evaluation

Bid Specification forms

- AIS Certification.

- American Iron and Steel.

- AIS Product Tracking Log.

- AIS De Minimis Product Tracking Log.

- Build America, Buy America Overview.

- Build America, Buy America (BABA) Pay Application Certification.

- Build America, Buy America (BABA) Product Tracking Log.

- Build America, Buy America (BABA) De Minimis Product Tracking Log.

- SRF Suspension and Debarment Certification.

- Davis Bacon certification form.

- US DOL SF 308 - request for wage determination and response to request.

- US DOL SF 1444 - request for authorization of additional class and rate.

- US DOL SF 1445 - labor standards interview.

- US DOL WH 347 - certified payroll.

- DBE Form B (due quarterly).

- EPA 6100-2 DBE subcontractor participation form.

- EPA 6100-3 DBE subcontractor performance form.

- EPA 6100-4 DBE subcontractor utilization form.

Self-certification

Owners choosing to self-certify will submit a form with a letter of intent to the division engineer and project manager.

Application deadlines are: Jan. 5, Feb. 5, April 5, June 5, Aug. 5, Oct. 5 and Nov. 5.

*If the loan application date falls on a holiday or weekend, loan applications will be accepted through midnight on the next business day.

CDPHE will accept applications once the required steps are completed:

- Pre-qualification form and completed meeting with SRF Agencies.

- Pre-qualification review letter with approval.

- Project Needs Assessment Approval

- Environmental Review with approval by GLU to move forward with the application.

- Public meeting.

- Plans and specification submission.

Submit all applications and forms using: Colorado Environmental Online Services (CEOS)

SRF Prioritization FAQ

Once the loan is executed and construction is going to begin, invite your project manager to the pre-construction meeting to answer any questions about the SRF requirements. Loan reimbursements are requested through CEOS.

Bid solicitation and contract review

Fiscal sustainability plan

Final inspection and project closeout

Additional loan information

State environmental review process

All proposed actions funded by the State Revolving Fund program must undergo an environmental review process to assess compliance with the intent of the National Environmental Policy Act (NEPA) and State Review Process (SERP). The State, borrower, engineer, contractor, and subcontractors must cooperate fully with federal and local governments and all other concerned public and private organizations, to use all practical means and measures including financial and technical assistance, and to create and maintain conditions under which man and nature can exist in productive harmony and promote the general welfare of the public.

The purpose of the environmental review is to evaluate the relevant environmental impacts and impact to the human environment of a federal action. The environmental review process includes one of three levels of review:

- Categorical Exclusion (CatEx).

- Environmental Assessment/Finding of No Significant Impact (EA/FNSI).

- Environmental Impact Statement/Record of Decision (EIS/ROD).

- SRF Environmental Review Process.

Environment forms and guidance

- Environmental checklist.

- Environmental assessment template and agency contact list.

- Environmental assessment memorandum.

Floodplain management

Environmental clearance

State Revolving Fund Grants

The State Revolving Fund (SRF) has two grants to help disadvantaged communities in funding their wastewater, stormwater, and drinking water projects. These are applied to communities and districts that intend to obtain an SRF subsidized loan.

These grants provide money to small communities to help cover costs associated with preparing the SRF project needs assessment. Grants require a 20 percent match from the applicant. Planning grant applicants must complete the pre-qualification form and attend a meeting.

Background

Planning grants can assist with costs up to $10,000 associated with the project needs assessment and/or environmental assessment development. This grant is specifically to help with the applications for the SRF loans.

Eligibility

- The project is on the current year's project eligibility list, or is being added to the subsequent year’s project eligibility list.

- The population is 10,000 or less.

- Entities meet one of the three data scenarios that test primary factors and, if necessary, secondary factors for determining disadvantaged communities. Factors are found in the Defining Disadvantaged Communities document.

Forms

Funds requested to form a special district should be included in the pre-qualification form.

Background

Design and engineering grant applicants will be considered with project needs assessment submissions and awarded to disadvantaged communities.

Design and engineering grant amounts depend on the size and need of a project. The grants assist with costs associated with eligible design expenditures. Up to 80 percent of the grant can be reimbursed before receiving the SRF loan application. The final 20 percent will be reimbursed upon SRF loan execution.

Eligibility

- Applicant must be a government entity.

- The project is on the current year's project eligibility list.

- The population is 10,000 or less.

- Entities meet one of the three data scenarios that test primary factors, and if necessary secondary factors for determining disadvantaged communities. Factors are found in the defining disadvantaged communities document.

Forms

Funds requested to form a special district should be included in the pre-qualification form.

Base SRF Program

| Program | Eligible Entity | Category | Direct Loan Rates (Loans <$3M) | Leveraged Loan Rates (Loans >$3M) | Loan Limit/Caps | Principal Forgiveness Caps | Planning Grant | D&E Grant | Notes |

|---|---|---|---|---|---|---|---|---|---|

| DWRF | Local Government | Non-DAC | 3.25% for 20 year 3.5% 30 year | Subsidized at 70-85% of Authority's AAA bond market rate | $30M total funding per entity (including PF) | N/A | No | No | N/A |

| DWRF | Private Not-For-Profit | Non-DAC | 3.75% for 20 year 4.0% 30 year | Subsidized at 70-85% of Authority's AAA bond market rate | $30M total funding per entity (including PF) | N/A | No | No | N/A |

| DWRF | Local Government | DAC Cat 1 | 2.5% for 20 year 2.75% for 30 year | Subsidized at 70-85% of Authority's AAA bond market rate | $30M total funding per entity (including PF) | Up to $1M in PF based on priority point scoring | Up to $10,000 | Up to $300,000 | N/A |

| DWRF | Private Not-For-Profit | DAC Cat 1 | 3.25% for 20 year 3.50% for 30 year | Subsidized at 70-85% of Authority's AAA bond market rate | $30M total funding per entity (including PF) | N/A | Up to $10,000 | No | Private Not for Profit entities are eligible for a planning grant and reduced interest rate on a loan if deemed a DAC, but are not eligible for D&E grants, or principal forgiveness on loans |

| DWRF | Local Government | DAC Cat 2 | 1.5% for 20 year 1.75% for 30 year | Subsidized at 70-85% of Authority's AAA bond market rate | $30M total funding per entity (including PF) | Up to $1M in PF based on priority point scoring | Up to $10,000 | Up to $300,000 | N/A |

| DWRF | Private Not-For-Profit | DAC Cat 2 | 2.5% for 20 year 2.75% for 30 year | Subsidized at 70-85% of Authority's AAA bond market rate | $30M total funding per entity (including PF) | N/A | Up to $10,000 | No | Private Not for Profit entities are eligible for a planning grant and reduced interest rate on a loan if deemed a DAC, but are not eligible for D&E grants, or principal forgiveness on loans |

| WPCRF | Local Government | Non-DAC | 3.25% for 20 year 3.5% 30 year | Subsidized at 70-85% of Authority's AAA bond market rate | $18M in total funding per entity (including PF) | N/A | No | No | Private Not for Profit entities are not eligible for funding in the WPCRF program |

| WPCRF | Local Government | DAC Cat 1 | 2.5% for 20 year 2.75% for 30 year | Subsidized at 70-85% of Authority's AAA bond market rate | $18M in total funding per entity (including PF) | Up to $500K in PF based on priority point scoring | Up to $10,000 | Up to $300,000 | Private Not for Profit entities are not eligible for funding in the WPCRF program |

| WPCRF | Local Government | DAC Cat 2 | 1.5% for 20 year 1.75% for 30 year | Subsidized at 70-85% of Authority's AAA bond market rate | $18M in total funding per entity (including PF) | Up to $500K in PF based on priority point scoring | Up to $10,000 | Up to $300,000 | Private Not for Profit entities are not eligible for funding in the WPCRF program |

| WPCRF | Local Government | Green Project Reserve (GPR) | 2.5% for 20 yr or 2.75 for 30 yr for 15% energy reduction of business case - 1.5% for 20 yr or 1.75% for 30 yr for 20% energy reduction of business case | GPR loans not leveraged since loan must be $3M or less | Up to $3M per project | N/A | Yes, If entity is a DAC, up to $10,000 | Yes, If entity is a DAC, up to $300,000 | Entities must submit a GPR business case for review and approval to receive a GPR loan. Loans greater than $3M will be split between a $3M GPR loan and a prevailing SRF loan |

IIJA SRF Program

| Program | Eligible Entity | Category | Direct Loan Rates (Loans <$3M) | Leveraged Loan Rates (Loans >$3M) | Loan Limit/Caps | Principal Forgiveness | Planning Grant | D&E Grant | Notes |

|---|---|---|---|---|---|---|---|---|---|

| DWRF Supplemental | Local Government | Non-DAC IIJA Eligible | 3.25% for 20 year 3.5% 30 year | Subsidized at 70-85% of Authority's AAA bond market rate | $30M total funding per entity (including PF) | ~50% PF of loan; Up to $1.5M in PF per project | No | No | Entity may only receive funding source one (1) time |

| DWRF Supplemental | Private Not-For-Profit | Non-DAC IIJA Eligible | 3.75% for 20 year 4.0% 30 year | Subsidized at 70-85% of Authority's AAA bond market rate | $30M total funding per entity (including PF) | ~50% PF of loan; Up to $1.5M in PF per project | No | No | Entity may only receive funding source one (1) time |

| DWRF Supplemental | Local Government | DAC Cat 1 | 2.5% for 20 year 2.75% for 30 year | Subsidized at 70-85% of Authority's AAA bond market rate | $30M total funding per entity (including PF) | ~50% PF of loan; Up to $2.5M in PF per project | Through Base Program | Through Base Program | N/A |

| DWRF Supplemental | Private Not-For-Profit | DAC Cat 1 | 3.25% for 20 year 3.750% for 30 year | Subsidized at 70-85% of Authority's AAA bond market rate | $30M total funding per entity (including PF) | ~50% PF of loan; Up to $2.5M in PF per project | Through Base Program | Through Base Program | N/A |

| DWRF Supplemental | Local Government | DAC Cat 2 | 1.5% for 20 year 1.75% for 30 year | Subsidized at 70-85% of Authority's AAA bond market rate | $30M total funding per entity (including PF) | ~50% PF of loan; Up to $2.5M in PF per project | Through Base Program | Through Base Program | N/A |

| DWRF Supplemental | Private Not-For-Profit | DAC Cat 2 | 2.5% for 20 year 2.75% for 30 year | Subsidized at 70-85% of Authority's AAA bond market rate | $30M total funding per entity (including PF) | ~50% PF of loan; Up to $2.5M in PF per project | Through Base Program | Through Base Program | N/A |

| DWRF Lead Service Line Replacement | Local Government | Non-DAC-IIJA Eligible | 3.25% for 20 year 3.5% 30 year | LSL Funds are not leveraged | $30M total loan funding per entity | ~50% PF of loan; Up to $10M in PF per project per year | No | No | Entity may only receive funding source one (1) time |

| DWRF Lead Service Line Replacement | Private Not-For-Profit | Non-DAC-IIJA Eligible | 3.75% for 20 year 4.0% 30 year | LSL Funds are not leveraged | $30M total loan funding per entity | ~50% PF of loan; Up to $10M in PF per project per year | No | No | Entity may only receive funding source one (1) time |

| DWRF Lead Service Line Replacement | Local Government | DAC Cat 1 | 2.5% for 20 year 2.75% for 30 year | LSL Funds are not leveraged | $30M total loan funding per entity | ~50% PF of loan; Up to $10M in PF per project per year | Through Base Program | Through Base Program | LSL grant funds do NOT count against the $30M loan limit if it is included in the same project |

| DWRF Lead Service Line Replacement | Private Not-For-Profit | DAC Cat 1 | 3.25% for 20 year 3.50% for 30 year | LSL Funds are not leveraged | $30M total loan funding per entity | ~50% PF of loan; Up to $10M in PF per project per year | Through Base Program | Through Base Program | LSL grant funds do NOT count against the $30M loan limit if it is included in the same project |

| DWRF Lead Service Line Replacement | Local Government | DAC Cat 2 | 1.5% for 20 year 1.75% for 30 year | LSL Funds are not leveraged | $30M total loan funding per entity | ~50% PF of loan; Up to $10M in PF per project per year | Through Base Program | Through Base Program | LSL grant funds do NOT count against the $30M loan limit if it is included in the same project |

| DWRF Lead Service Line Replacement | Private Not-For-Profit | DAC Cat 2 | 2.5% for 20 year 2.75% for 30 year | LSL Funds are not leveraged | $30M total loan funding per entity | ~50% PF of loan; Up to $10M in PF per project per year | Through Base Program | Through Base Program | LSL grant funds do NOT count against the $30M loan limit if it is included in the same project |

| DWRF Emerging Contaminants | Local Government and Private Not-For-Profit | Non-DAC IIJA Eligible | N/A (100% PF loan) | EC Funds are not leveraged | $30M total loan funding per entity | 100% PF loan; Up to $30M in PF per project per year | No | No | Entity may only receive funding source one (1) time |

| DWRF Emerging Contaminants | Local Government and Private Not-For-Profit | DAC Cat 1 and 2 | N/A (100% PF loan) | EC Funds are not leveraged | $30M total loan funding per entity | 100% PF loan; Up to $30M in PF per project per year | Through Base Program | Through Base Program | 25% of EC funding is reserved for entities that are DAC or <25,000 pop, 75% can go any local gov with eligible project EC tranche of funds do NOT count against the $30M loan limit if it is included in the same project |

| WPCRF Supplemental | Local Government | Non-DAC IIJA Eligible | 3.25% for 20 year 3.5% 30 year | Subsidized at 70-85% of Authority's AAA bond market rate | $18M in total funding per entity (including PF) | ~50% PF of loan: Up to $500k in PF per project | No | No | Private Not for Profit entities are not eligible for funding in the WPCRF program |

| WPCRF Supplemental | Local Government | DAC Cat 1 | 2.5% for 20 year 2.75% 30 year | Subsidized at 70-85% of Authority's AAA bond market rate | $18M in total funding per entity (including PF) | ~50% PF of loan: Up to $1.5M in PF per project | Through Base Program | Through Base Program | Private Not for Profit entities are not eligible for funding in the WPCRF program |

| WPCRF Supplemental | Local Government | DAC Cat 2 | 1.5% for 20 year 1.75% 30 year | Subsidized at 70-85% of Authority's AAA bond market rate | $18M in total funding per entity (including PF) | ~50% PF of loan: Up to $1.5M in PF per project | Through Base Program | Through Base Program | Private Not for Profit entities are not eligible for funding in the WPCRF program |

| WPCRF Emerging Contaminants | Local Government | Non-DAC IIJA Eligible | N/A (100% PF loan) | EC Funds are not leveraged | $18M in total loan funding per entity | Currently no limit | No | No | WPCRF Emerging Contaminants funding is available to Non-DAC's, but DAC's are prioritized |

| WPCRF Emerging Contaminants | Local Government | DAC Cat 1 and 2 | N/A (100% PF loan) | EC Funds are not leveraged | $18M in total loan funding per entity | Currently no limit | Through Base Program | Through Base Program | EC tranche of funds does NOT count against the $18M funding limit if it is included in the same project |

Regulations and fund rules

- Drinking Water Revolving Fund rules: Regulation 52.

- Water Pollution Control Revolving Fund rules: Regulation 51.

Green project reserve

- Green Project Reserve: Green business case guidance, approved green business cases.

- 2012 Green Project Reserve Guidance

Approved green business cases

- Woodland Park green business case.

- Lyons green business case.

- Stratton green business case.

- Tabernash Meadows Water and Sanitation District green business case.

- Mountain WSD green business case (Drinking Water Revolving Fund project).

- Mountain WSD green business case (Water Pollution Control Revolving Fund project).

- Crowley green business case.

- Nederland green business case.

- Forest View Acres green business case.

- Town of Crested Butte Business Case

- Town of Wellington Business Case

SRF documents and information

Workshops and webinars

SRF outreach and education meetings happen throughout the year. Check back often for one in your area or sign-up on the SRF Grants and loans mailing list.

We partner with the Department of Local Affairs and the Colorado Water Resources and Power Development Authority to conduct statewide workshops.

The workshops covered the State Revolving Fund borrower benefits:

-

Grant opportunities.

-

Low-interest rates.

-

Flexible terms.

NEW developments were also included

-

Updated disadvantaged community criteria.

-

Overview of CEOS - the online project submittal portal.

-

Discharger-specific variances.